AARP, Horizon and others are well known but they will not process your claim any differently than a no name company. I would not put any weight in the company name. I would personally pick one of the top three for pricing, look at how recently their rates changed and factor in a few other options. I often get asked which company is the best and ultimately the company doesn’t matter a whole lot. When you add in the discounts of up to 7%, it brings the prices down and puts them at the top of the list for best pricing. If you are turning 65 and your spouse isn’t too far behind, I would look at one of these companies first. My favorites are Aetna and Mutual of Omaha. There are a few companies in NJ that offer discounts for spouses and even for people that are in the same household. Since plan G can only be purchased by those that are in their initial enrollment or can medically qualify, it has a healthier pool of people and thus has lower claims over time keeping the prices more stable. You are also guaranteed to save in premium when compared to Plan F. I personally would choose Plan G, followed by Plan N and lastly Plan F.įrom what I have seen for at least the five years, Plan G has much lower increases over time when compared to Plan F. It is 15% above what Medicare would allow for that expense. Excess charges can happen if your provider does not accept Medicare assignment and it gives them the right to bill you a little extra. One last thing to note is that Plan N does not cover excess charges. For emergency rooms, you have a $50 copay. Just like Plan G, you will need to pay your Part B deductible and then also once that is met, you will need to pay a copay of $20 at your doctor.

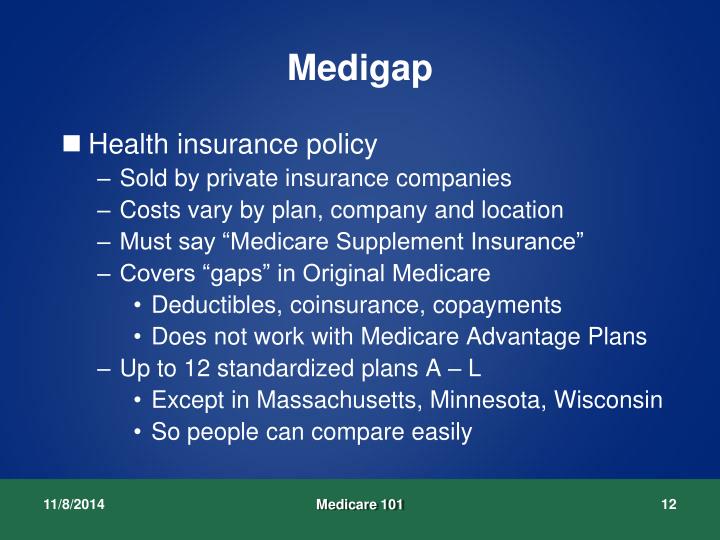

Plan N: The lowest plan we usually look at is Plan N and will fall right around $40-$50 less per month than Plan F. You will save roughly $240 and only need to pay your deductible. You can typically expect to spend about $20 less per month compared to Plan F. Once you meet that deductible, this plan will work exactly like Plan F with everything covered 100%. Plan G: Plan G is identical to Plan F except you need to pay your annual Part B deductible. This means it is also the most expensive plan. It is the easiest plan to work with because you will never have to pay a copay or worry about a bill. Plan F: Plan F will cover all of your expenses except for prescriptions 100%. Most people will purchase either Plan F, Plan G or Plan N. What is the best Medigap Policy to Buy in New Jersey? What do each of the different Medigap Plans in New Jersey Cover? Cost is usually the only difference between Medigap policies with the same letter sold by different insurance companies. Each standardized Medigap policy must offer the same basic benefits, no matter which insurance company sells it. Every Medigap policy must follow Federal and state laws designed to protect you, and the policy must be clearly identified as “Medicare Supplement Insurance.” Medigap insurance companies in most states can only sell you a “standardized” Medigap policy identified by letters A through N. Note: Medicare doesn’t pay any of the costs for you to get a Medigap policy.

A Medigap policy is different from a Medicare Advantage Plan (like an HMO or PPO) because those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. If you have Original Medicare and a Medigap policy, Medicare will pay its share of the Medicare approved amounts for covered health care costs. This means it helps pay some of the health care costs (“gaps”) that Original Medicare doesn’t cover (like copayments, coinsurance, and deductibles). What is a Medigap policy?Ī Medigap policy (also called “Medicare Supplement Insurance”) is private health insurance that’s designed to supplement Original Medicare.

#Horizon bcbs medigap free

Quotes are always free and I’m happy to give you my opinion on all the Medigap plans. I usually can respond within the hour or will get to you as soon as I can. The fastest way to get the information you need is to go ahead and send me a quote request. If you already know what a Medigap Plan is, feel free to skip ahead to the section on the rates for Medigap Plans in New Jersey These plans are also referred to as Medicare Supplement plans in NJ. This will be a resource post to New Jersey residents that are shopping for a Medigap Plan in NJ.

0 kommentar(er)

0 kommentar(er)